You have watched manganese sulfate prices go up and stay steady from 2015 to 2025. These changes are important for people who work with batteries, farming, or steel. If you follow each price change, you learn things that help you plan money choices or handle supplies. Manganese sulfate helps make batteries and helps crops grow better. You need to watch every price change closely.

Manganese sulfate prices went up and down from 2015 to 2025 because demand and supply changed. Electric cars make people want more manganese sulfate, mostly for batteries. Farmers also use manganese sulfate to help crops grow, so this adds to the need for it. China is the biggest country in the manganese market and affects prices everywhere. Prices may become more steady in the future as new mines and factories make more manganese sulfate to match the demand.

Manganese Sulfate Price Trend Overview

2015–2020 Price Movements

Between 2015 and 2020, the price of manganese sulfate changed often. Prices started at a medium level. Sometimes prices went up, and sometimes they went down. Many things caused these changes. Electric cars needed more batteries during these years. This made people want more high-purity manganese sulfate. Farmers also wanted more manganese sulfate for their crops. This made demand even higher. Mining and making manganese sulfate sometimes stopped. Bad weather or new rules could pause supply for a short time. When supply stopped, prices usually went up.

Note: The price trend for manganese sulfate depended on both demand and supply. You had to look at both to understand the market.

Here is a table that shows the main things that changed the manganese sulfate price between 2015 and 2020:

Factor | Description |

|---|---|

Surge in EV battery production | More electric cars meant more need for high-purity manganese sulfate. |

Agricultural demand cycles | Demand changed with planting and harvesting seasons. |

Mining and production disruptions | Weather or new rules sometimes stopped supply. |

Raw material availability | How much manganese ore there was changed costs and supply. |

International trade policies | Rules about trading affected how much manganese sulfate moved between countries. |

The manganese market also grew in value. The world market for manganese sulfate reached about USD 602.5 million. Europe made up over 30% of this, with USD 180.75 million in 2024. The market grew at a rate of 3.5% each year from 2024 to 2031. This growth happened because demand went up and supply stayed steady.

2021–2025 Price Shifts

From 2021 to 2025, new price trends appeared for manganese sulfate. There was strong demand for battery-grade and high-purity manganese sulfate. Most of this demand came from electric cars. The price for battery-grade manganese sulfate stayed in a certain range. Sometimes prices changed as supply and demand shifted.

At the end of 2024, the price trend for manganese sulfate went down. Many things caused this change:

Weak demand from China, especially because less steel rebar was needed for buildings

Production problems, like the outage at South32’s Groote Eylandt mine after a tropical cyclone

These things made prices lower and more steady as 2025 started. The market became less wild, and prices were easier to predict. The price trend for manganese sulfate in 2025 showed stability. This helped people plan better for the future.

The market value kept growing. The manganese sulfate market is expected to grow at a rate of 13.0% each year from 2025 to 2031. This strong growth means more chances for people in the future. When you try to guess what will happen next, you need to think about supply, demand, and outside things like weather or trade rules. These things will change the prices and trends you see in the manganese sulfate market.

Manganese Sulfate Market Drivers

Battery Demand Impact

Electric cars are changing the manganese market a lot. More people want electric cars now. This makes the need for manganese in batteries grow quickly. Car makers pick manganese batteries because they cost less. These batteries also use fewer rare metals like nickel and cobalt. This change helps the manganese sulfate market stay strong.

The need for manganese in batteries will be eight times higher this decade.

Electric cars help keep prices up, especially for lithium manganese iron phosphate and other types with lots of manganese.

Problems with politics and shipping can make it hard to get enough manganese, which can make prices go up.

The US and Australia are building new plants to make supply steadier and not rely so much on China.

The expected growth rate for manganese sulfate from battery demand is 6.2%. This growth is tied to more electric cars and more batteries. When you look ahead, battery demand will keep affecting manganese sulfate prices for many years.

Agricultural and Steel Uses

Farmers also need manganese sulfate to help crops grow. This need gets bigger as more people want sustainable and organic food. In Europe and North America, farmers use more manganese sulfate every year.

More farmers use agricultural grade manganese sulfate for better crops.

Organic farming makes the need for manganese sulfate even higher, especially in rich countries.

If the cost of raw materials changes, the price of manganese sulfate can go up or down.

Most manganese is still used by the steel industry. Even though battery demand is rising, steel keeps the manganese market steady. When you watch these trends, you see how farming and steel work with battery growth to shape the future of the manganese sulfate market.

Regional Manganese Prices

China Price Trends

China is the leader in the manganese market. Most manganese sulfate comes from China. China sets the main price for manganese worldwide. Prices in China have stayed steady lately. The supply chain in China is strong. This keeps manganese sulfate prices from changing a lot. If people in China buy fewer batteries or less steel, prices change fast everywhere. Factories in China can change how much they make quickly. This helps keep prices stable even when demand goes up or down. Manganese ore prices in China are important too. These ore prices change how much it costs to make manganese sulfate. If ore prices go up, manganese sulfate prices usually go up soon after.

North America Market

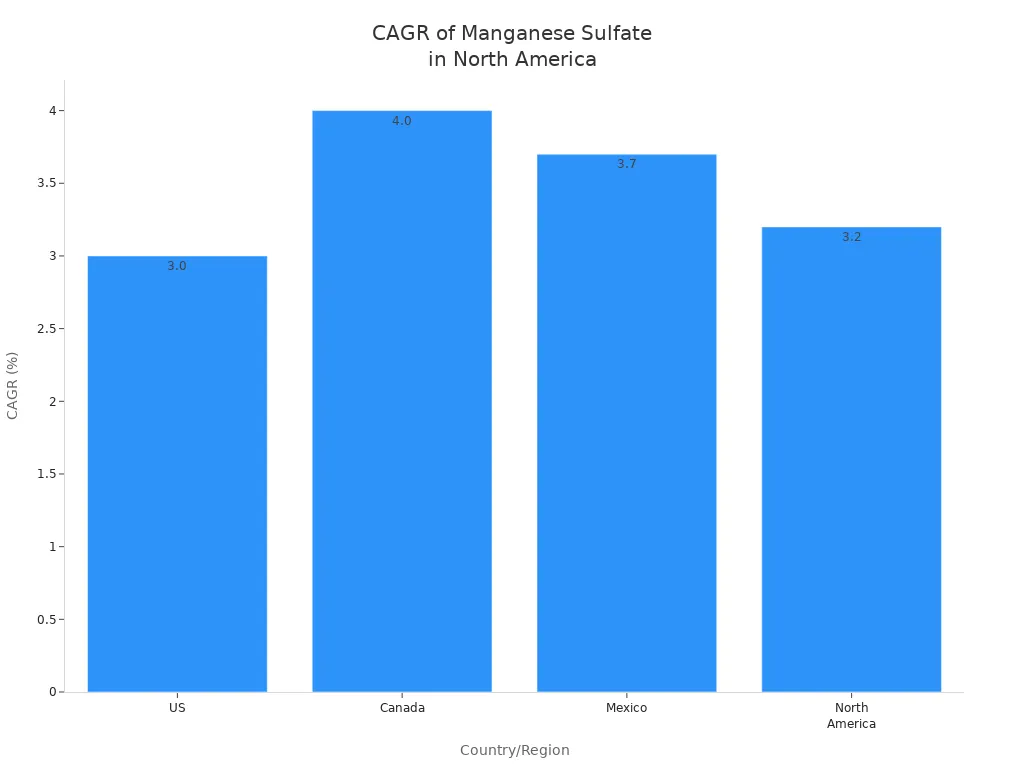

North America has a different trend. The manganese sulfate market is growing here. The US, Canada, and Mexico all want more battery materials and fertilizers. This need helps the market get bigger. You can see how fast each country grows in the table below:

Country | CAGR (%) |

|---|---|

US | |

Canada | 4.0 |

Mexico | 3.7 |

North America | 3.2 |

Canada has the fastest growth rate. The US and Mexico also have strong demand. North America’s supply chain is getting better. But it still needs imports from Asia. This makes prices change when global supply changes. When you look at prices in North America, you see they often follow China’s trends.

Other Regions

Europe and Southeast Asia also matter in the manganese market. Europe has steady demand for farming and batteries. Supply in these places can be less steady. Prices can change quickly because of this. The global market value keeps going up as more countries use manganese sulfate for new technology. The market grows as demand spreads to more places. Local supply and demand affect prices in each region. When you compare regions, you see global and local things both change manganese prices.

Tip: Watch global and local supply changes. These can help you guess future price moves in the manganese market.

Manganese Sulfate Market Forecast

2025 Price Outlook

The market for manganese sulfate in 2025 will be steady. Prices will not change much from past years. Supply and demand will be balanced. Battery makers and farmers will keep buying manganese sulfate. New mines and factories will add more supply. This extra supply will stop prices from rising fast.

Note: When prices stay steady, it is easier to plan your budget and manage your stock.

Here is a table that shows what might happen in 2025:

Factor | 2025 Outlook |

|---|---|

Supply | More mines and factories |

Demand | Strong from batteries, steady from farming |

Pricing | Stable, small changes |

Market forecast | Growth continues |

The manganese market will grow slowly and steadily. New supply will meet the higher demand. You can use this forecast to help your business choices.

Future Market Dynamics

You should watch a few things that can change prices. Supply is important. If new mines open or factories make more, there will be more manganese sulfate. This can keep prices low. If bad weather or new rules stop supply, prices can go up fast.

Demand will also change over time. Electric cars will need more batteries. Battery makers will buy more manganese sulfate. Farmers will still use it for crops. If new technology needs more manganese, demand could rise even more.

Rules from the government matter too. New mining or trade rules can change supply and prices. You should keep up with news about mining laws and trade.

Here are some tips for making forecasts:

Watch for new mines and factories.

Check how much battery makers and farmers need.

Follow news about rules and trade.

Use market facts to change your plans if needed.

If you pay attention to these things, you can make good choices and avoid problems in the manganese sulfate market.

To guess the price trend, look at supply, demand, and rules. Steady supply and strong demand help keep prices stable. The market will keep growing, but you should be ready for changes.

You can see how manganese market trends affect your choices. Prices are different in each region. For example, China’s price is $850. France’s price is $1,320.

Asia-Pacific and Latin America want more manganese sulfate. You need to change your plan for each place. To do well, you should:

Work with good partners

Watch for new rules

If you know how prices work and how supply chains move, you can plan better. You can also react fast when the market changes.

FAQ

What is manganese sulfate used for?

Manganese sulfate is used in batteries, farming, and steel. Battery makers need it for electric cars. Farmers use it to help crops grow better. Steel factories use it to make metal stronger.

Why do manganese sulfate prices change?

Prices change when supply or demand goes up or down. If more people want batteries or crops, prices go up. If mines make more manganese, prices go down.

How do you track manganese sulfate prices?

You can find prices on market websites or in reports. Many companies post price updates online. You should also read news about mining and battery trends.

Which country sets the main price for manganese sulfate?

China sets the main price for manganese sulfate. Most mines and factories are in China. When China changes how much it makes, prices change everywhere.

Related Posts

I am Edward lee, founder of manganesesupply( btlnewmaterial) , with more than 15 years experience in manganese products R&D and international sales, I helped more than 50+ corporates and am devoted to providing solutions to clients business.