The Global Market for Manganese Dioxide was valued at approximately USD 23.5 million in 2024. The Asia-Pacific and North American regions experienced the most significant growth within this market.

Region | Market Size (USD Million) | Percentage of Global Market |

|---|---|---|

North America | Over 40% | |

Europe | 7.05 | Over 30% |

Asia Pacific | 5.41 | About 23% |

Latin America | 1.18 | More than 5% |

Global Total | 23.5 (2024 estimate) | N/A |

Batteries account for over 90% of sales in the Global Market for Manganese Dioxide, driven by the high demand for battery materials in electric vehicles and renewable energy storage. Additionally, there is strong demand from water treatment applications and industrial manufacturing. Asia-Pacific leads in both production and consumption of manganese dioxide, while North America maintains steady demand due to battery usage and environmental regulations. The Global Market for Manganese Dioxide is projected to grow at a CAGR of 6.1% from 2026 to 2033, fueled by increasing demand for its critical applications.

The global manganese dioxide market is growing slowly but steadily. This is mostly because more batteries are needed for electric cars and storing renewable energy. Asia-Pacific and North America are the top regions in this market. Asia-Pacific is growing the fastest because it has strong factories and technology companies. Electrolytic manganese dioxide is the most important type. It is needed to make alkaline and lithium-ion batteries. Water treatment, ceramics, and glass also help the market grow. Tough environmental rules and supply chain problems make things harder. But these problems push companies to use greener and better ways to make products. New ideas in nanomaterials, recycling, and battery technology give the market more chances to grow. New markets in Latin America and the Middle East & Africa are opening up. These places are growing because of help from governments and new factories. Top companies do well by spending money on research, being eco-friendly, and working with others. This helps them meet higher demand and stay ahead of others.

Market Overview

Market Size

The global manganese dioxide market has grown slowly in recent years. The electrolytic manganese dioxide market was worth USD 1.58 billion in 2023. This happened because more industries need it, especially for batteries and water cleaning. The global manganese dioxide market report says the market keeps getting bigger as companies use new ways to make it. Both natural and synthetic manganese dioxide are part of the global market, but electrolytic manganese dioxide is the most valuable because it is important for making batteries.

The manganese dioxide market report says the market is spread out in many places. Asia-Pacific, North America, and Europe are the biggest areas for this market. The global manganese dioxide market grows because factories are busy and more people use electric vehicles. The global manganese dioxide market report also says the market size in 2024 is about USD 23.5 million, but the electrolytic manganese dioxide market is worth more because it is used for special things.

Note: Old data shows the global manganese dioxide market has grown every year. This is because of better technology and more need for batteries.

Growth Forecast

Experts think the global manganese dioxide market will keep growing fast. The global manganese dioxide market report says the CAGR will be between 5.25% and 7.0% until 2033. The electrolytic manganese dioxide market should grow from USD 2.47 billion in 2024 to USD 4.71 billion by 2032. This means a CAGR of 8.40%. This shows that batteries are very important, especially for electric vehicles and storing energy from the sun or wind.

Forecast Period | CAGR (%) | Market Size Start (USD Billion) | Market Size End (USD Billion) |

|---|---|---|---|

2026-2033 | 5.25 | 1.15 | 1.80 |

2024-2032 (EMD) | 8.40 | 2.47 | 4.71 |

The global manganese dioxide market will probably get more sales from batteries. The global manganese dioxide market report says water cleaning and factories will also help the market grow. During the forecast years, companies will find new chances as more money goes into research and development.

Key Segments

The manganese dioxide market report splits the market into different groups. These groups are type, use, grade, product form, end-user industry, source, and location. The global manganese dioxide market has both natural and synthetic types, but electrolytic manganese dioxide is the main one for batteries.

Segment Category | Main Segments / Sub-segments |

|---|---|

By Type | Dry Cell Batteries, Lithium-ion, Zinc-Carbon, Alkaline |

By Application | Batteries, Water Treatment, Ceramics, Glass, Fertilizers, Animal Feed |

By Grade | Electrolytic, Industrial, Battery, Food |

By Product Form | Powder, Granular, Lumps |

By End-User Industry | Electronics, Aerospace, Automotive, Construction, Pharmaceuticals |

By Source | Natural, Synthetic |

By Geography | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

The global manganese dioxide market report says batteries are growing the fastest. The global market analysis shows more manganese dioxide will be needed for batteries, especially for electric vehicles and big battery storage. Water cleaning, ceramics, and glass making are also important parts of the manganese dioxide market. The electrolytic manganese dioxide market is still needed for battery cathodes, especially in alkaline, lithium, and sodium batteries.

Tip: Companies should check the manganese dioxide market report for news about how each group is doing and new trends. This helps them find new chances and change when the market changes.

Global Market for Manganese Dioxide

Demand Drivers

The global manganese dioxide market is getting bigger. Many industries want better ways to store energy and clean water. There are a few main reasons why this market is growing. Companies see more people buying batteries. This is true for electric vehicles and systems that store energy from the sun or wind. Electrolytic manganese dioxide is very important for zinc-carbon and lithium-ion batteries. These batteries are used in lots of new technology.

Governments give money and rewards to help people buy electric vehicles. These rules make more people want batteries. This helps the manganese dioxide market get bigger. New ways to make manganese dioxide are faster and better. This makes the market even stronger. Companies spend money on research to make nanostructured manganese dioxide. This helps batteries work better and last longer.

Manganese dioxide is also used to clean water. Electrolytic manganese dioxide takes out bad stuff from water. This is good for cities and factories. Factories use manganese dioxide to help make chemicals, ceramics, and glass. This means more people need it. The market report says energy storage is growing fast. This helps renewable energy and makes more people want good battery materials.

Note: More people want batteries for electric vehicles and water cleaning. This is a big reason why the market keeps growing.

Electrolytic manganese dioxide is used a lot in batteries.

Governments help people buy electric vehicles and use clean energy.

New technology makes batteries work better and faster.

More people need manganese dioxide to clean water.

Energy storage is getting bigger and helps renewables.

Factories use manganese dioxide for chemicals, ceramics, and glass.

Restraints

Even though the market is growing, there are some problems. There are strict rules about how to throw away and make batteries. These rules cost companies a lot of money. For example, the European Union’s REACH rule makes companies spend about $200 million more each year. Companies must use safer ways to make things and change how they work.

The price of raw materials can change a lot. Problems between countries and broken supply chains make it hard to get manganese ore. This makes prices go up and down. In 2023, these problems made manganese ore exports drop by 15%. This hurt how much companies could make and made the market less steady. Making manganese dioxide uses a lot of energy. This is 25% of all costs. This makes it hard for companies to make money and grow.

The market report says new materials and battery types are a threat. These new things mean people might not need as much manganese dioxide. There are many small companies in the market. This makes it hard to keep quality the same and makes competition tough. It costs a lot to start a new company. This stops new companies from joining and slows down new ideas. Bad roads and power problems make it more expensive and less efficient to make manganese dioxide.

New materials can replace electrolytic manganese dioxide.

Supply chain problems happen because only a few countries make manganese.

Making manganese dioxide uses a lot of energy and costs more.

Many small companies make it hard to make money.

It costs a lot to start a new company or try new things.

Complicated rules slow down new products and stop new companies.

Not enough skilled workers makes it hard to improve and work well.

Slow use of new technology makes work less efficient.

Tip: Companies should invest in better supply chains and save energy. This can help them beat these problems and do better in the manganese dioxide market.

Global Electrolytic Manganese Dioxide Market

The global electrolytic manganese dioxide market is getting bigger. Many industries want better materials for batteries and energy storage. Companies use electrolytic manganese dioxide in dry cell, lithium-ion, and other strong batteries. The manganese dioxide market grows because more people want electric vehicles and energy storage.

Battery Applications

Electrolytic manganese dioxide is very important for battery cathodes. Manufacturers use it to make dry cell, lithium-ion, and alkaline batteries. Almost every big battery type needs electrolytic manganese dioxide.

Lithium-ion

Lithium-ion batteries need pure electrolytic manganese dioxide for good energy storage. These batteries power electric cars, portable gadgets, and medical tools. The manganese dioxide market gives lithium batteries materials for high energy. Lithium-ion batteries make up about 27% of the electrolytic manganese dioxide market. Companies work to make batteries better for new energy storage needs.

Manufacturers pick electrolytic manganese dioxide for lithium-ion batteries because it makes them light and strong. The global market grows as more people buy electric cars and portable electronics. Lithium-ion batteries are still very important for future energy storage.

Alkaline

Alkaline batteries are the biggest part of the electrolytic manganese dioxide market. These batteries use manganese dioxide as the main cathode. The market gives alkaline batteries to electronics, toys, and home devices. Alkaline battery grade electrolytic manganese dioxide is about 49% of the whole market.

Dry cell batteries, like alkaline ones, need electrolytic manganese dioxide to work well. The global market helps make billions of alkaline batteries each year. Manufacturers keep making batteries better and cheaper.

Note: Electrolytic manganese dioxide is about 62% of all battery material demand. Almost 45% of market money comes from battery cathodes.

Aspect | Details |

|---|---|

Primary Use | Cathode material in batteries (alkaline and lithium-ion) |

Battery Manufacturing Demand | Represents approximately 62% of total global EMD demand |

Battery Cathode Revenue Share | Nearly 45% of total EMD market revenue in 2023 |

Alkaline Battery Grade EMD | Accounts for around 49% of total EMD market |

Lithium-Ion Battery Grade EMD | Accounts for nearly 27% of total EMD market |

Applications | Used in electric vehicles, portable electronics, and medical devices |

Regional Trends

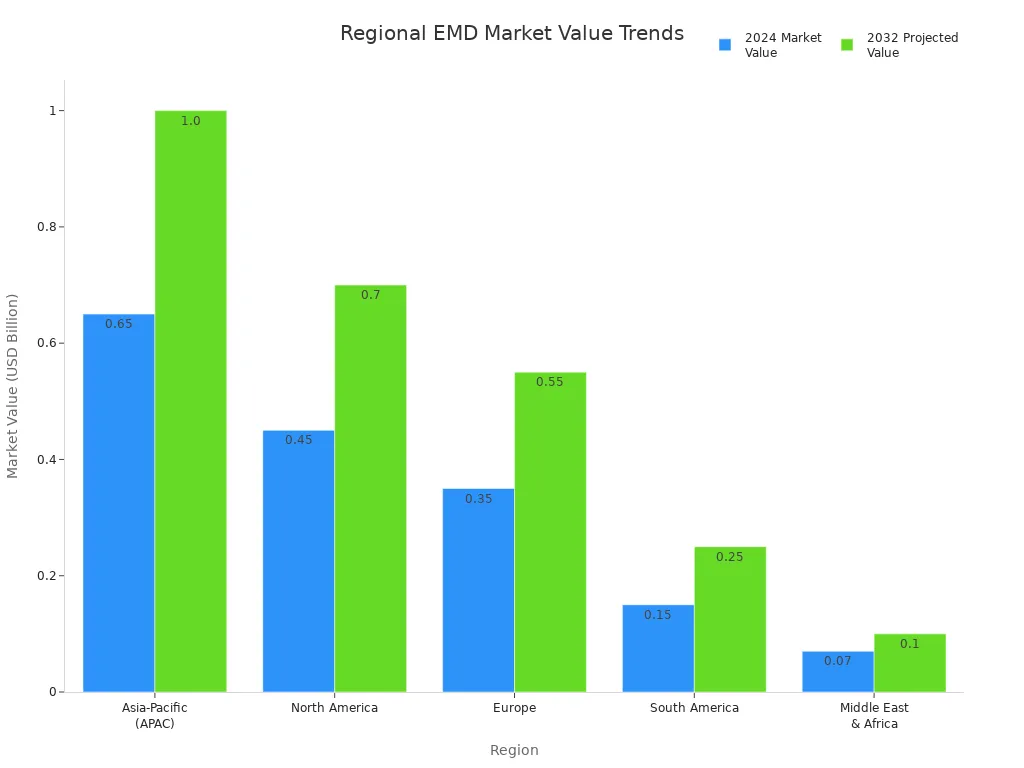

The global electrolytic manganese dioxide market is growing in many places. Asia-Pacific is the leader with a market value of $0.65 billion in 2024. It could reach $1.0 billion by 2032. North America is next, helped by renewable energy and new battery technology. Europe uses more electrolytic manganese dioxide for energy storage and batteries. South America and the Middle East & Africa are starting to grow, mostly in mining and factories.

Region | 2024 Market Value (USD Billion) | 2032 Projected Value (USD Billion) | Key Growth Drivers and Trends |

|---|---|---|---|

Asia-Pacific (APAC) | 0.65 | 1.0 | Leading region due to strong automotive and electronics sectors driving demand for EMD. |

North America | 0.45 | 0.7 | Growth supported by renewable energy applications and battery technologies. |

Europe | 0.35 | 0.55 | Increasing use in renewable energy and battery tech sectors. |

South America | 0.15 | 0.25 | Emerging opportunities linked to mining and steel production. |

Middle East & Africa | 0.07 | 0.1 | Smallest market but growing due to industrialization efforts. |

The manganese dioxide market keeps growing as more places buy electric cars, energy storage, and strong batteries. Companies in the global electrolytic manganese dioxide market work on new ideas and better ways to make products to meet higher demand.

Manganese Dioxide Market Segmentation

Natural Manganese Dioxide

Natural manganese dioxide is very important in this market. Mining companies get it from ore deposits. They process it for factories to use. Manufacturers need natural manganese dioxide for cleaning water, making ceramics, and glass. This compound helps take out iron and manganese from water. Glassmakers use it to make their products stronger and better looking. Ceramic makers add it to improve how their items look and last.

Asia-Pacific uses the most natural manganese dioxide. This is because factories and buildings are growing fast. China’s mining industry gives much of the world’s supply. It helps make batteries and clean water. North America and Europe also use natural manganese dioxide. They focus on protecting the environment and making advanced products. Producers have problems like changing prices and strict rules. Companies work on better mining to keep supplies steady.

Note: Natural manganese dioxide is still needed for old industries. Scientists are looking for new ways to use it in energy and technology.

Manganese Dioxide Powder

Manganese dioxide powder is a fast-growing part of the market. Factories make this fine powder for batteries, cleaning water, ceramics, glass, and food. The powder is the main material in alkaline and zinc-carbon batteries. It helps electric cars and electronics grow. Water plants use manganese dioxide powder to clean water. It helps remove bad stuff from water in cities and factories.

Glass and ceramic makers use the powder to add color and strength. Food companies use it to keep food fresh longer. The powder helps stop food from going bad. Asia-Pacific uses about 55% of all manganese dioxide powder. China makes lots of batteries and invests in electric cars. This makes demand go up. North America and Europe also use more powder. They use it for advanced products and to follow environmental rules.

Manufacturers have problems like changing prices and other materials competing. But there are chances to make powder in better ways. Recycling and using renewable energy can help. The market for manganese dioxide powder should grow at 9.7% each year from 2025 to 2032. Many industries want more powder.

Main uses for manganese dioxide powder:

Making batteries (alkaline, lithium-ion, zinc-carbon)

Cleaning and purifying water

Making glass and ceramics

Keeping food fresh

Tip: Companies should watch market trends and try new ways to make powder. Looking at electrolytic manganese dioxide market groups can help find new chances to grow.

Regional Insights

Asia-Pacific

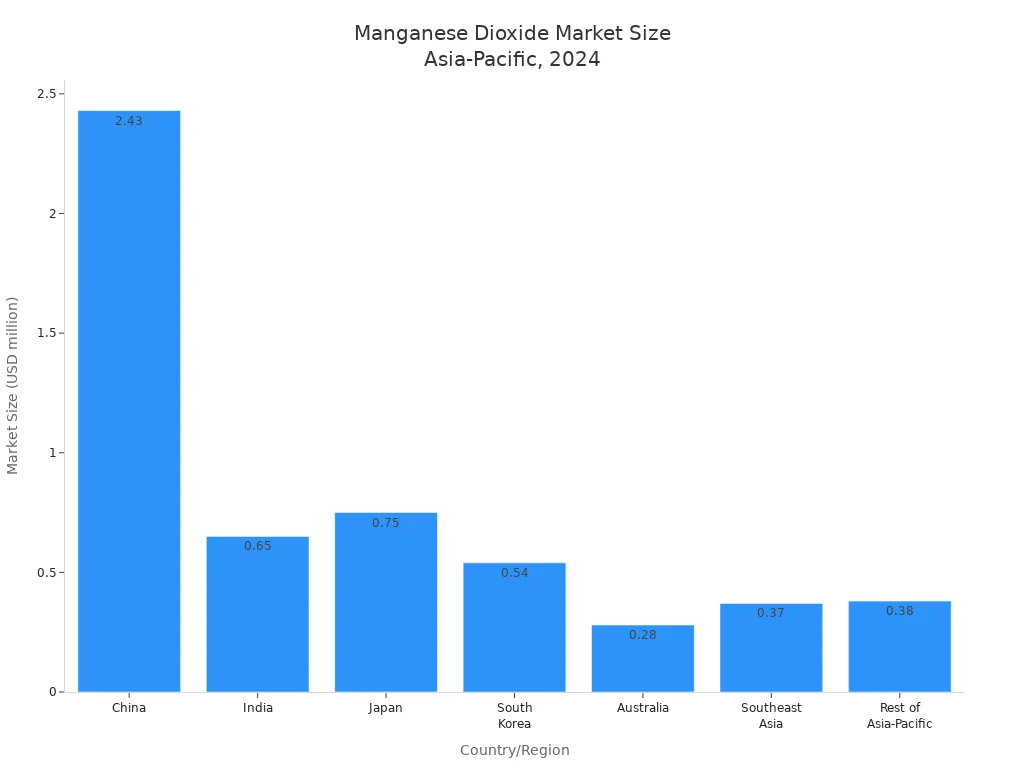

Asia-Pacific is the fastest-growing area for manganese dioxide. In 2024, its market size was USD 5.41 million. This is about 23% of the world’s total. The region grows because factories and new buildings are going up fast. More people use new technology here. Environmental rules help people use more manganese dioxide.

Metric | Value | Notes |

|---|---|---|

Market Size (2024) | USD 5.41M | 23% of global market revenue |

CAGR (2024-2031) | 3.8% | Strongest among global regions |

China Market Size (2024) | USD 2.43M | Largest in region, 3.3% CAGR |

India Market Size (2024) | USD 0.65M | Fastest growth, 5.6% CAGR |

Japan Market Size (2024) | USD 0.75M | 2.3% CAGR |

South Korea Market Size (2024) | USD 0.54M | 2.9% CAGR |

Australia Market Size (2024) | USD 0.28M | 3.5% CAGR |

Southeast Asia Market Size (2024) | USD 0.37M | 4.8% CAGR |

China makes and uses the most manganese dioxide. This is because it builds lots of electric cars and batteries. India is next. Its government helps companies make more steel and batteries. Japan and South Korea help the market with their high-tech factories. Big companies like Xiangtan Electrochemical Scientific Ltd and MOIL Limited are important here. Asia-Pacific gives about 55% of the world’s manganese oxide. This helps meet the need for batteries, steel, and electronics.

Note: Asia-Pacific will need more manganese dioxide as electric cars, energy storage, and new technology become more common.

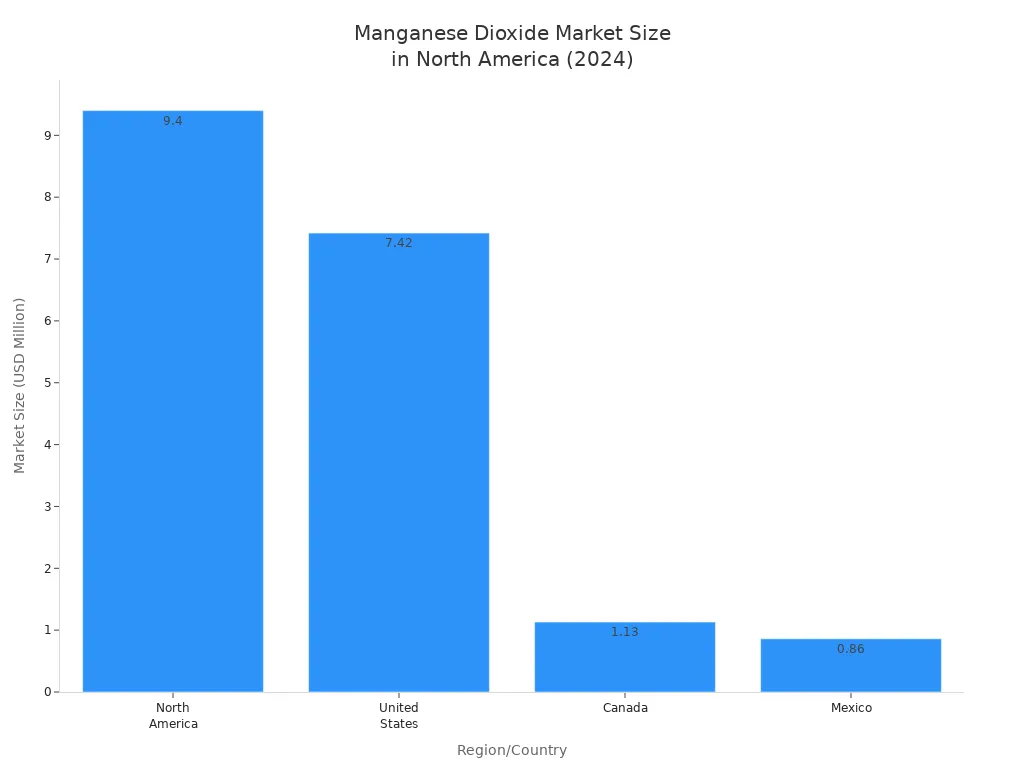

North America

North America has over 40% of the world’s manganese dioxide market. In 2024, the market size was USD 9.40 million. The United States is the biggest part, then Canada and Mexico. The market here does not change much. From 2024 to 2031, growth is expected to stay at 0.0%.

Region/Country | Market Size (USD Million, 2024) | CAGR (2024-2031) |

|---|---|---|

North America | 9.40 | 0.0% |

United States | 7.42 | -0.2% |

Canada | 1.13 | 0.8% |

Mexico | 0.86 | 0.5% |

Most demand in North America comes from making batteries, cleaning water, and electronics. Manganese dioxide is used in lithium-ion batteries for electric cars. The government gives money and support for battery factories. California, Michigan, and Ontario are important places for this market. The region also grows in energy storage and recycling old batteries. People want clean energy and electric cars, so demand stays strong.

Europe

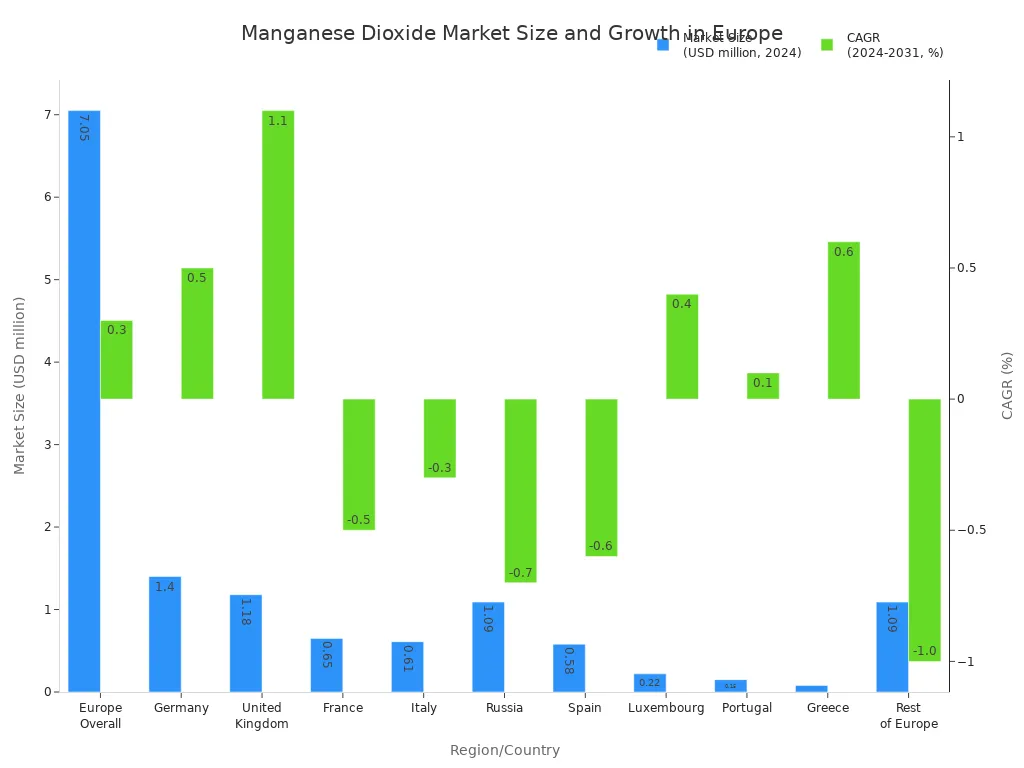

Europe has more than 30% of the world’s manganese dioxide market. In 2024, its market size was USD 7.05 million. Growth is slow, with a 0.3% increase expected by 2031. The United Kingdom and Germany use the most. France, Italy, and Russia are using less.

Region/Country | Market Size (2024, USD million) | CAGR (2024-2031) | Notes |

|---|---|---|---|

Europe Overall | 7.05 | 0.3% | 30%+ global market share |

United Kingdom | 1.18 | 1.1% | Steady demand in batteries, water, energy |

Germany | 1.40 | 0.5% | Growth in batteries, catalysts, ceramics |

France | 0.65 | -0.5% | Negative growth |

Italy | 0.61 | -0.3% | Negative growth |

Russia | 1.09 | -0.7% | Negative growth |

Spain | 0.58 | -0.6% | Negative growth |

Luxembourg | 0.22 | 0.4% | Moderate growth |

Portugal | 0.15 | 0.1% | Slight growth |

Greece | 0.08 | 0.6% | Moderate growth |

Rest of Europe | 1.09 | -1.0% | Declining market |

Europe needs manganese dioxide for batteries, water cleaning, and storing renewable energy. The government helps with money and new battery ideas. Electric cars and green rules help keep demand steady. The United Kingdom and Germany are growing the most. Other countries are staying the same or getting smaller. Europe’s focus on clean energy and new materials should keep demand steady in the future.

Latin America

Latin America is becoming important for manganese dioxide. Industries want new ways to make batteries and clean energy. Electrolytic manganese dioxide leads the market here. People need more lithium-ion and alkaline batteries. This is because there are more electric vehicles and renewable energy projects.

Some trends are shaping how manganese dioxide is used in Latin America:

EMD is the main choice because battery makers need pure materials for electric vehicles and energy storage.

Companies in Brazil and Chile work on better EMD. They want it to be more pure and stable. This helps batteries last longer and work better.

Green methods like bioleaching and low-temperature processing are getting popular. These ways help the environment and save money.

The market is growing outside batteries. Healthcare uses manganese dioxide for medical imaging. Water treatment plants use it to help with water problems and keep people healthy.

Governments in Brazil and Chile have stricter rules for the environment. Producers now focus on eco-friendly ways to get manganese dioxide.

Brazil and Chile are leaders because they have lots of manganese and good roads and factories. Peru and Argentina are starting new mining projects. This could mean more supply soon.

Partnerships, new technology, and recycling batteries help the market grow and stay strong.

Note: Latin America’s focus on being green and trying new ideas helps it compete in the world manganese dioxide market.

Middle East & Africa

The Middle East & Africa region has about 2% of the world’s manganese dioxide market. In 2024, the market size was USD 0.47 million. It should grow by 1.5% each year until 2031. Most demand comes from batteries, water treatment, and electronics. More electric vehicles and renewable energy also help the market grow.

Region/Country | Market Size (USD million, 2024) | CAGR (2024-2031) | Key Drivers/Notes |

|---|---|---|---|

Middle East & Africa | 0.47 | 1.5% | About 2% of global market; batteries, water treatment, electronics, EVs, mining activities |

GCC Countries | 0.20 | 2.3% | Growth batteries and electronics |

Egypt | 0.05 | 1.8% | Steady growth |

South Africa | 0.07 | 2.5% | More demand and new industrial uses |

Turkey | 0.04 | 1.0% | Moderate growth |

Nigeria | 0.05 | 0.6% | Slower growth |

Rest of MEA | 0.06 | 0.5% | Moderate growth |

Most manganese dioxide here is less than 99% pure. Batteries, water cleaning, and electronics use most of it. The market gets stronger as more people buy electric vehicles and use renewable energy. But rules and problems between countries can slow things down. Big companies spend money on research and new technology. They also make partnerships to stay ahead. South Africa and GCC countries grow the fastest. Nigeria and other places grow more slowly.

Tip: Companies should focus on new ideas and strong local partnerships. This helps them solve problems and find new chances in this market.

Competitive Landscape

Leading Companies

The global manganese dioxide market has big companies and new ones. These companies make new products and set rules for the industry. Some important companies are:

Tosoh Bioscience LLC

South Manganese Investment Limited

Vibrantz

Mesa Minerals Partners

METAL POWDER GROUP

Cegasa

Borman Specialty Materials

BariteWorld

MOIL Limited

Tronox Holdings Plc.

RecycLiCo Battery Materials Inc.

Xiangtan Electrochemical Scientific Ltd (China)

ERACHEM (Belgium)

Tosoh Corporation (Japan)

Delta EMD Pty Ltd (South Africa)

Minera Autlan (Mexico)

Guangxi Guiliu Chemical Co., Ltd. (China)

Prince International Corporation (United States)

Quintal S.A. (Brazil)

These companies lead by making better products and doing research. Some, like Xiangtan Electrochemical Scientific Ltd and Tosoh Corporation, care about the environment and make pure products. Others, such as Delta EMD and Tronox Holdings Plc., make new battery products.

Market Share

No company controls the whole manganese dioxide market. Many companies have strong positions in different places and product types. Chinese companies, like Xiangtan Electrochemical Scientific Ltd and CITIC Dameng Holdings Limited, are important in their region. Tosoh Corporation and Tronox Holdings Plc. sell to many countries and work with different industries.

Company Name | Region | Focus Area |

|---|---|---|

Xiangtan Electrochemical Scientific | China | EMD, sustainability |

Tosoh Corporation | Japan | High-purity EMD, innovation |

Tronox Holdings Plc. | United States | Battery materials, new products |

Delta EMD Pty Ltd | South Africa | |

MOIL Limited | India | Mining, supply chain |

Cegasa | Spain | Battery applications |

Note: Companies do not share exact market share numbers. Experts say these leaders keep the market balanced.

Strategies

Big companies use different ways to stay ahead. They spend money on research to make better products and find new uses. Many work with battery makers to build new lithium-ion batteries. For example, Delta EMD works with a top battery company. Tosoh Corporation makes more high-purity EMD.

Companies also try to help the environment. Xiangtan Electrochemical Scientific Ltd made a process that is better for nature. Tronox Holdings Plc. started a new EMD for solid-state batteries. Prince International Corporation got money to make lithium-ion batteries work better.

Some main strategies are:

Making products special with price, new ideas, and good service

Using technology and data to work faster and smarter

Growing in new places by working with other companies or buying them

Using recycled materials and making less pollution

Building strong supply chains and protecting their ideas

Changing products for different customers

Tip: Companies that mix new ideas, caring for the planet, and strong teamwork do best. Watching trends and what others do helps them stay ahead.

Sustainability Trends

Green Production

Manufacturers want to make manganese dioxide in greener ways. They use new methods that are better for the environment. Over 60% of new mining projects will use these methods by 2025. This is a big change for the industry.

Companies use hydrometallurgical beneficiation to get manganese from lower-grade ores. This helps the environment and makes less waste. Automation and remote sensing help workers do their jobs faster and safer. Carbon footprint tracking helps companies see how much they affect the environment.

A new hydrometallurgical process for making electrolytic manganese dioxide skips the old calcination step. This means less iron needs to be cleaned out and ferrous iron gets reused. It uses less energy. A new cell design lets iron (II) ions be used again during leaching. This saves power and cuts down on waste. These changes help companies spend less money and make production more eco-friendly.

Companies that use green production can do better than others. They follow strict rules and people think better of them.

Industry experts say these new ideas help make manganese production greener. More companies are using these technologies. The market expects even more improvements soon.

Regulatory Impact

Environmental rules affect the manganese dioxide market in many ways. Governments make strict laws about waste, pollution, and chemicals. These laws force companies to use cleaner ways to make products. Following the rules costs more money and makes it harder for new companies to start.

These rules push companies to invent new ways to make manganese dioxide and manage supplies. Now, companies look for raw materials that are better for the planet and recycle more. This matches circular economy ideas. Places like China, Japan, and South Korea have very strict rules. These rules change how much it costs to make things and how steady the market is.

In 2023, the world recycled about 45.2 million tons of manganese. Tougher rules for mining help recycling grow. Companies use designs that save energy and materials that can be recycled. This helps them follow rules about pollution and e-waste. ESG frameworks now guide how companies act. They must share how they help the planet and meet global goals like the UN SDGs.

Social and governance issues, like worker rights and clear supply chains, matter more when buying materials. Top companies spend money on new ideas, green methods, and digital tools to stay ahead. Experts say it is hard to balance rule-following costs with staying competitive. But these rules help recycling and cleaner production grow.

Tip: Companies that follow rules and care about the planet will do well in the manganese dioxide market for a long time.

Opportunities

Innovation

There are many chances for new ideas in the manganese dioxide market. Companies spend money to make better materials and ways to process them. Recent studies show some big changes that could shape this industry’s future.

MnO2 nanomaterials are now important for supercapacitors and many batteries. They are cheap and can be used in many ways for storing energy.

Zinc-ion batteries work better with β-MnO2 and polypyrrole. This mix helps the batteries hold more power.

MnO2-based air-working actuators can bend and change shape. This helps make smart devices that can move in new ways.

α-MnO2 helps ammonium-ion energy storage stay strong, even after lots of use.

MnO2 mixed with graphitic carbon nitride is a good electrocatalyst. It gives strong current and needs less extra voltage.

Studies also show manganese dioxide nanosheets could help in medicine. Their large surface and redox activity make them good for biosensors, drug delivery, and MRI scans. Factories now make very pure synthetic manganese dioxide for better batteries. Recycling old batteries to get manganese dioxide helps the planet and supports a circular economy.

New hydrometallurgical extraction methods help get more manganese dioxide and hurt the environment less. Companies use artificial intelligence and machine learning to make mining and processing better. Engineers change particle size and surface to make batteries work better. Battery makers and manganese processors work together to keep supply chains safe. Greener ways to make manganese dioxide, like using solar power and recycling water, help meet world sustainability goals.

Companies that work on new ideas and care about the planet do better than others. Studies say using manganese dioxide in medicine and advanced manufacturing, like 3D printing, will help the market grow.

Emerging Markets

New markets give the manganese dioxide industry big chances to grow. Studies show Asia-Pacific is the main area for growth. Countries like China, Japan, South Korea, India, Indonesia, and Thailand lead in demand. These countries have more factories, more people buying things, and strong electronics businesses.

Asia-Pacific uses the most manganese dioxide in the world. The region’s growing healthcare and phone industries also help the market.

Latin America, especially Mexico and Brazil, has a lot of manganese and uses it in factories.

The Middle East & Africa, including Turkey and Saudi Arabia, grow because of new factories and mining projects.

Studies show making electric vehicles, government help for clean energy, and more people living in cities all make demand go up. Asia-Pacific’s rules help factories grow. Latin America’s government support and new trade rules in the Middle East & Africa change how the market works.

Better battery technology and new uses in medicine, communication, and electric cars also make demand higher. Studies say lower prices and better technology in Asia-Pacific, like Indonesia and Thailand, help these countries grow fast. More types of factories and government help in the Middle East & Africa and Latin America give new chances for manganese dioxide makers.

Companies that watch trends and change to fit local needs can grow in these new areas. Studies show working together, using new technology, and caring about the planet help companies win in these fast-growing markets.

The global manganese dioxide market is growing fast. Batteries are the main reason for this growth. Water treatment also helps the market get bigger. Asia-Pacific and North America have more chances to grow. People in the market can use these strategies:

Use tools to help decide when to enter new markets.

Watching how supply chains work, rules change, and technology gets better helps companies stay ahead. Checking forecasts and looking at regions often helps people make smart choices in the global manganese dioxide market.

FAQ

What is manganese dioxide used for?

Manganese dioxide is used in batteries, water cleaning, and making ceramics and glass. Factories use it to take out bad stuff and make products better. Battery makers need it for the cathodes in lithium-ion and alkaline batteries.

Why does Asia-Pacific lead in manganese dioxide production?

Asia-Pacific is first because factories and tech companies need a lot of manganese dioxide. China and India have big mining businesses and strong factories. These countries spend money on new battery and water cleaning technology.

How does manganese dioxide support green energy?

Manganese dioxide helps batteries work better in electric cars and storing green energy. Companies use it to make batteries last longer and charge quickly. This helps clean energy goals and cuts down on pollution.

What challenges do manganese dioxide producers face?

Producers deal with tough environmental rules, changing prices, and supply chain problems. High energy costs and new materials make things harder. Companies must use new technology and care for the planet to stay ahead.

Which companies are leaders in the manganese dioxide market?

Big companies are Tosoh Corporation, Xiangtan Electrochemical Scientific Ltd, Tronox Holdings Plc., and Delta EMD Pty Ltd. These leaders work on new ideas, care about the planet, and team up with battery makers.

Is manganese dioxide safe for water treatment?

Manganese dioxide safely takes out iron and manganese from water. Water plants use it to make water better. Safety groups check its use to keep people and nature safe.

What new trends shape the manganese dioxide market?

New trends are green ways to make it, recycling old batteries, and making nanomaterials for better batteries. Companies also use artificial intelligence to help mining and processing.

How can companies benefit from emerging markets?

Companies can grow by putting money into Asia-Pacific, Latin America, and the Middle East & Africa. These places have new chances in batteries, water cleaning, and factories. Local teamwork and using new technology help companies do well.

Related Posts

I am Edward lee, founder of manganesesupply( btlnewmaterial) , with more than 15 years experience in manganese products R&D and international sales, I helped more than 50+ corporates and am devoted to providing solutions to clients business.