Manganese carbonate (MnCO₃) is a commonly used raw material in industries such as ceramics, battery precursors, fertilizers, pigments, and chemical manufacturing. For international buyers, the delivered or “landed” cost often matters more than the ex-factory price alone. In this blog, we break down all the cost components of delivering manganese carbonate to your country, explain how each part works, and show sample cost tables with real-world data. This transparency helps buyers and suppliers make better decisions.

Factors That Influence Manganese Carbonate Pricing

When you see a quote like “USD 800/MT CIF to USA,” that number hides many sub-costs. Below are the typical cost drivers and how they vary.

1. Raw Material & Production Costs

The base cost of manganese carbonate is determined by ore cost, purity, production yield, chemical reagents, energy, labor, and overhead.

On Alibaba, many suppliers list factory (FOB or EXW) prices for manganese carbonate in the range of USD 750 to 1,300 / MT (for industrial grade)。

In China, some listings show “industrial grade MnCO₃, 44-46% Mn” at ~ ¥4,000 / MT (~ USD 600) .

Because of scale, major factories may achieve lower costs, but the listed range gives an idea of current market range.

2. Packaging Costs

Packaging for manganese carbonate is nontrivial: you need moisture barrier liners, strong bags, possibly palletization, or jumbo bags.

Packaging type and quality can add non-negligible cost, especially for export shipping.

For bulk exports, super sacks (FIBCs) or jumbo bags are often used instead of 25 kg paper bags, which reduce cost per ton.

You might estimate packaging as ~ 2–5 % of the ex-factory cost, depending on material, liner, pallet, etc.

3. Transportation Costs (Internal to Port + Main Freight)

Internal transport to port: road, rail, or barge from factory to loading port. This depends heavily on distance, infrastructure, road condition, fuel, etc.

Main freight (ocean shipping, possibly inland shipping in buyer country)

Sea freight fluctuates with global rates.

For example, as of recent years, sea bulk freight for minerals has ranged roughly USD 50–150 / MT depending on route and contract.

Insurance and marine risk premium may be 0.1–0.3 % of CIF value.

In manganese ore indexes, semi-carbonate with 36.5 % Mn sees CIF to Tianjin pricing in $/dmtu (dry metric ton unit) terms, which is used in ore trade pricing.

In metals trading news, semi-carbonate grades (36 %) were offered at $3.80–3.90 per dmtu CIF to Vizag (India) for manganese ore semi-carbonate grades (not pure carbonate), which gives a rough sense of freight + margin for bulk mineral products.

4. Customs Duties & Import Taxes

The import duty depends on your country’s tariff schedule and the HS code of manganese carbonate.

For many countries, manganese compounds fall under “HS 2833.xxxx” or similar headings. You need to check your country’s tariff schedule.

For example, if your country imposes 5 % import duty plus 10 % VAT (on cost + duty), that increases the landed cost.

In some markets, anti-dumping duties or special mineral excise duties may also apply.

5. Insurance & Documentation Fees

Exporters often charge document preparation (COA, SDS, certificate of origin, inspection) and inland insurance.

Bill of lading, fumigation, export permits — these are usually fixed or per-container costs.

As a rule of thumb, insurance + docs might add ~ 1–2 % of the CIF value.

6. Hidden / Miscellaneous Costs

Port handling (stevedoring, container handling, bulk loading)

Demurrage, storage fees if delays

Customs clearance fees in buyer country

Inland trucking from port to buyer’s plant

Banking charges (L/C, T/T fees), currency exchange loss

Quality testing in buyer country (importer labs)

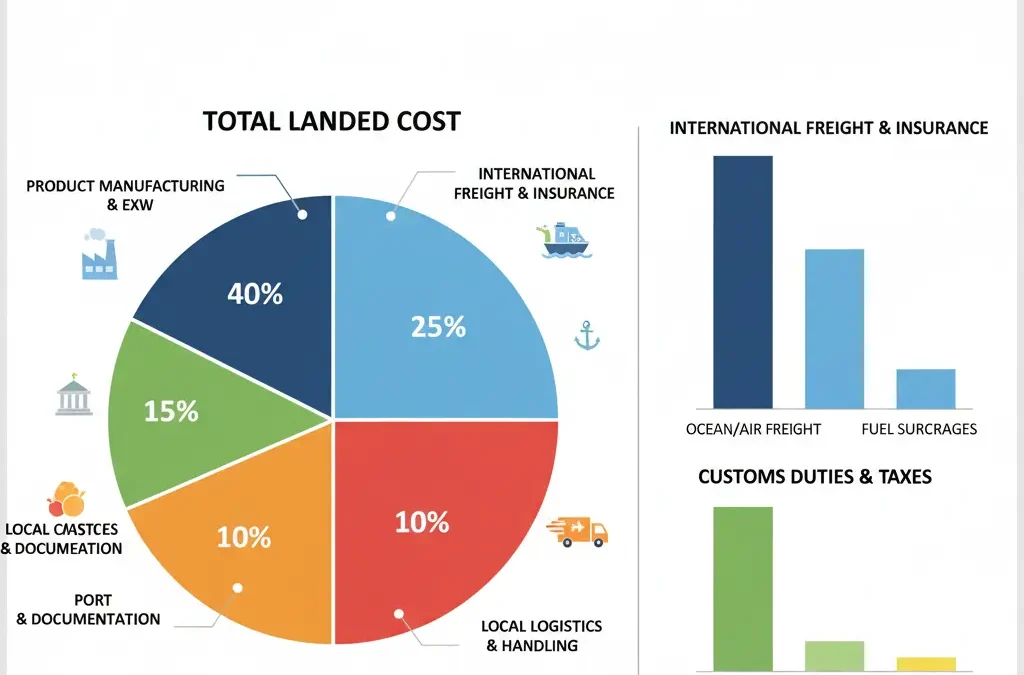

Example Cost Breakdown Table

Below is a representative cost breakdown for a shipment of manganese carbonate from China to the USA, for 1 metric ton. The numbers are illustrative (not exact) but based on real ranges discussed above.

| Cost Component | % of Total | Example (USD / MT) | Notes / Assumptions |

|---|---|---|---|

| Factory ex-factory price | 60 % | 600 | Based on factory quoting ~ USD 600–1,000 |

| Packaging | 3 % | 30 | Jumbobags, liners, pallet etc. |

| Inland transport to port | 4 % | 40 | Factory → Shanghai port, road cost |

| Ocean freight + insurance | 20 % | 200 | Sea freight + marine insurance |

| Export documentation & fees | 1 % | 10 | BL, COA, permit, inspection |

| Import duty + VAT / tariff | 8 % | 80 | Assumed duty + VAT on CIF |

| Port handling & clearance | 3 % | 30 | Stevedoring, customs clearance |

| Inland trucking (USA side) | 2 % | 20 | Port → buyer plant |

| Banking / misc / margin | 2 % | 20 | L/C charges, margin buffer |

| Total landed cost (Landed) | 100 % | 1,030 | — |

In this scenario, a buyer in the USA might see a landed cost of ~ USD 1,030 / MT for manganese carbonate (industrial grade). The factory price gives the largest share, but freight, duty, and handling are also material.

If instead the buyer is in Southeast Asia (e.g. Singapore, Malaysia), inland trucking and ocean freight may be lower, so the landed cost might shrink to ~ USD 850–950 / MT, depending on port distances and trade routes.

Cost Breakdown for the Top 10 Importing Countries of Manganese Carbonate from China

Note: The following tables and calculations are illustrative estimates only. Actual landed costs depend on your specific shipment terms, port of destination, tariff classification, and freight conditions.

| Country | Factory | Packaging | Inland to Port | Freight | Insurance & Docs | CIF | Duty (USD) | VAT (USD) | Port Handling | Inland Truck | Bank/Misc | Landed (USD/MT) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USA | 600 | 30 | 40 | 200 | 20 | 890.00 | 44.50 | 0.00 | 30 | 50 | 20 | 1,034.50 |

| Germany | 600 | 30 | 40 | 220 | 20 | 910.00 | 54.60 | 192.12 | 30 | 60 | 20 | 1,266.72 |

| Netherlands | 600 | 30 | 40 | 210 | 20 | 900.00 | 54.00 | 199.14 | 30 | 50 | 20 | 1,253.14 |

| India | 600 | 30 | 40 | 150 | 20 | 840.00 | 63.00 | 169.74 | 30 | 40 | 20 | 1,162.74 |

| Japan | 600 | 30 | 40 | 120 | 20 | 810.00 | 24.30 | 83.43 | 30 | 30 | 20 | 997.73 |

| South Korea | 600 | 30 | 40 | 130 | 20 | 820.00 | 24.60 | 84.46 | 30 | 30 | 20 | 1,009.06 |

| Brazil | 600 | 30 | 40 | 300 | 20 | 990.00 | 118.80 | 133.46 | 30 | 80 | 20 | 1,372.26 |

| Vietnam | 600 | 30 | 40 | 80 | 20 | 770.00 | 0.00 | 77.00 | 30 | 20 | 20 | 917.00 |

| Thailand | 600 | 30 | 40 | 100 | 20 | 790.00 | 39.50 | 59.57 | 30 | 25 | 20 | 964.07 |

| Australia | 600 | 30 | 40 | 180 | 20 | 870.00 | 43.50 | 91.35 | 30 | 60 | 20 | 1,114.85 |

Cost-Saving Tips by Country

USA: Consider negotiating CIF vs. FOB terms. Inland trucking in the US can be expensive; optimizing port of entry (East Coast vs. West Coast) may reduce domestic transport costs.

Germany: VAT is reclaimable for registered importers. Choosing Hamburg vs. Rotterdam may affect freight and handling fees.

Netherlands: Rotterdam is a major entry hub. Buyers can benefit from bonded warehousing to delay VAT payment.

India: Consolidating shipments and using bonded warehouses can reduce duty and clearance costs. Partnering with a local customs broker improves efficiency.

Japan: Shorter shipping routes keep freight low. Work with local forwarders for smoother port handling.

South Korea: Check if the China–Korea FTA applies to your HS code, which may reduce or eliminate duty.

Brazil: Duties are high. Importers should explore bulk shipment contracts to dilute freight cost per ton.

Vietnam: ASEAN–China FTA may reduce duty to 0 %. Consolidated trucking from port to plant minimizes inland costs.

Thailand: Importers should check if preferential duty applies under ASEAN–China agreements. Local customs brokers help optimize clearance.

Australia: Australia–China FTA may reduce duties. Selecting the nearest port (Sydney vs. Melbourne vs. Brisbane) reduces inland trucking expenses.

Data Sources & Calculation Methodology

Factory Price Assumption: USD 600/MT (based on average supplier listings on Alibaba and Echemi, 2024).

Freight Estimates: Approx. USD 80–300/MT depending on distance and route, referencing typical bulk shipping rates published by Fastmarkets and OPIS.

Duty & VAT Rates: Estimated average tariff + VAT based on WTO/ITC Tariff Lookup and public customs schedules (values are simplified examples).

Formula:

CIF = Factory + Packaging + Inland to Port + Freight + Insurance & Docs

Duty = CIF × duty %

VAT = (CIF + Duty) × VAT %

Landed = CIF + Duty + VAT + Port Handling + Inland Truck + Misc

Important: These figures are estimates. Please verify tariff classification under HS Code 2833.25 (Manganese carbonate) or equivalent in your country’s customs system.

WTO Tariff Lookup: https://tao.wto.org

ITC Market Access Map: https://macmap.org

Example HS Code Info (US): USITC DataWeb

How Buyers Can Reduce Costs

Choose favorable Incoterm (FOB, CIF, DDP, etc.)

If the buyer has strong logistics capabilities in their country, they may prefer FOB: pay up to port in China and then contract shipping themselves (to capture freight savings).

If logistics are challenging, CIF is easier (supplier includes freight and insurance) but margined.

DDP is the most “turnkey” but often has higher risk and cost for the seller.

Consolidate shipments / full container loads

Partial container loads have higher per-ton freight and handling cost.

Full container loads (FCL) or full bulk cargo can reduce unit freight cost.

Optimize packaging & pallet loads

Use bulk packing (e.g., jumbo bags) instead of small 25 kg bags.

Efficient pallet stacking to reduce wasted space.

Long-term freight contracts

Locking in freight rates with carriers reduces fluctuation risk.

Select nearby ports & optimize routing

Choose loading ports nearer your factory or cheaper routes.

Use transshipment only when necessary.

Negotiate with customs agents / brokers

Efficient customs handling with lower misc fees.

Pre-clearance, documentation accuracy to avoid delays.

Order larger volumes to dilute fixed costs

Bigger orders mean fixed costs (docs, inspection, packaging set-up) are spread over more tons.

Why Work Directly with a Manufacturer (Factory)

Cost transparency: direct manufacturers can show breakdowns (raw, labor, freight) rather than opaque margins.

Customized logistics: factory can coordinate shipping, packaging, export formalities.

Quality control: direct factory can ensure certificate of analysis (COA), consistent purity, testing before shipment.

Better lead time: less middleman, fewer handovers, faster responses.

Volume discounts: manufacturers often prefer large orders, giving better pricing.

FAQ

Q: What is the HS code / classification for manganese carbonate?

A: It is typically under chemical / inorganic compounds classification (for instance, HS 2833.xxxx in many countries). But the precise sub-code depends on your national tariff schedule. Always ask your customs or freight forwarder to verify.

Q: How high can import duty be?

A: It varies widely. In some countries 0–5 %; in others, more. Also VAT or GST is applied on CIF + duty. Example: if duty = 5 % and VAT = 10 %, then duty on USD 800 = 40, then VAT on 840 = 84, total 124 extra.

Q: What is a typical CIF USA price?

A: Based on the breakdown above, a CIF landed cost around USD 800–1,100 / MT is plausible (depending on grade, shipping route, volume). In some Alibaba listings, factory prices for MnCO₃ are in USD 750–1,300 / MT — adding freight, duty, and margin could bring the CIF to ~ USD 900–1,200.

Q: How volatile are freight costs?

A: Very volatile. Global container and bulk freight rates swing with demand, fuel costs, supply chain disruption. Thus every freight contract should consider fluctuation buffers.

Q: Where can I get real quotes?

A: Ask multiple suppliers (factories) for FOB and CIF to your port quotes. Ask for breakdowns: factory cost, inland, freight, insurance, docs. Compare and request them to show how they built up their price.

Conclusion

Understanding the full cost breakdown of manganese carbonate delivery is essential for informed procurement. The landed cost is made up of multiple components: factory cost, packaging, transport, freight, duties, handling, and misc expenses. While factory price often seems the biggest component, the “hidden” parts can shift margins significantly. As a manganese carbonate manufacturer, we believe in transparency, custom quotes, and helping buyers optimize logistics.

Related Posts

I am Edward lee, founder of manganesesupply( btlnewmaterial) , with more than 15 years experience in manganese products R&D and international sales, I helped more than 50+ corporates and am devoted to providing solutions to clients business.